Pre- and Post-Loan Support

Borrowers

Community Capital Business Advisory Services provides technical assistance to borrowers

Community Capital offers optional, free pre- and post-loan support to help you navigate the challenges of starting and running a small business. Using your loan funds effectively is key to long-term business success, from the time you anticipate receiving a loan, until you sell or transfer your business. Working with experienced Business Advisors to design actionable, customized plans and attainable goals will improve the viability of your business.

Making the Most of a Community Capital Loan

- Business planning: Create a roadmap as to how to structure, manage and grow your business as it develops

- Financial projections: Forecast your business costs, sales, cash flow and income in order to anticipate and plan for whatever comes next

- Work plans: Organize around business tasks, projects or concepts for smooth operations

- Strategic direction: Create a course of action that reflects your vision, mission, strategy and goals to reflect your big picture

- Website design: Connect to the world with your products, services and story for the best branding, sales, and communication

- Social media training: Engage with past, present and future customers and reinforce your brand through powerful word-of-mouth networks

- QuickBooks classes: Learn basic bookkeeping and accounting skills and tools, to enable accurate financial management and decision making

- Financial management: Make the best decisions for your business related to taxes, investment and compensation

- Marketing, sales, and advertising assessments: Tell your story in the most cost-effective way, to the right people

- Technical infrastructure: Understand the best investments in technology as appropriate for your business

- Production, delivery, and operations: Find the best suppliers, and the most effective means of producing, sourcing, and delivering your product or service

- Succession and divestiture: Make the most of your investment with a profitable sale or transfer of ownership

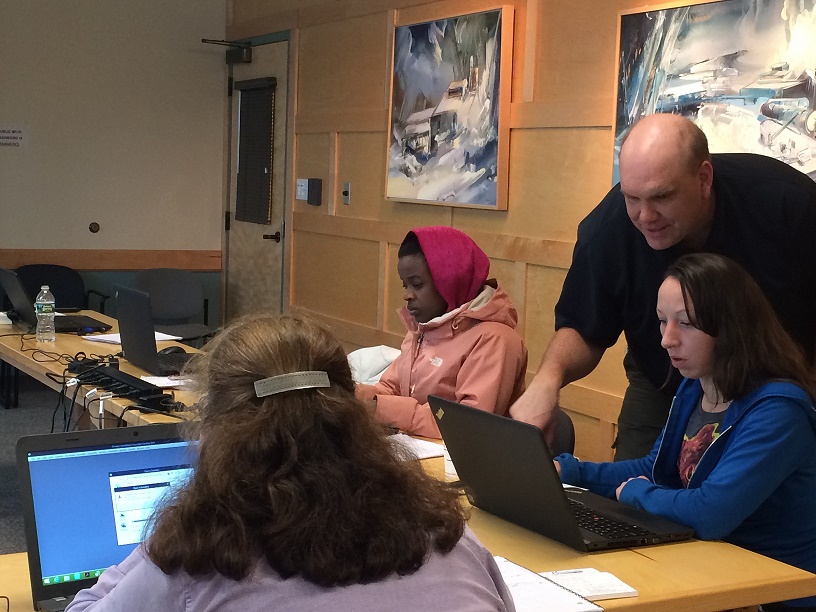

Focus on QuickBooks for Long-term Business Success

Community Capital regularly provides borrowers across the state with free QuickBooks accounting training. These practical learning workshops are delivered by a certified QuickBooks ProAdvisor and the Business Advisory Services team. Each student is supplied with a laptop for the day of the training, and participants receive a complete QuickBooks manual. For more information please see the events section of our Facebook page or website events page.

Introduction to Quick Books

Introduction to QuickBooks is for participants new to QuickBooks, or those who would like to refresh and practice their basic skills. The class covers the Chart of Accounts, creating customers, invoices, and receiving payments, creating vendors, entering bills, making payments and printing checks; the check register, and many more QuickBooks tips and tricks.

QuickBooks Reconciliation, Taxes, and Reports

This intermediate-level class trains participants with some QuickBooks background to reconcile your bank statement using QuickBooks, calculate taxes includes sales, use, and rooms and meals, run reports, and read QuickBooks-generated financial statements.

Community Capital Business Advisors help assess your strengths and turn weaknesses into opportunities to improve your own business quality, efficiency, and delivery.

Dan French, The Strike Zone, Essex Junction

The Strike Zone in Essex trains young athletes for success in baseball – and in life. Owner Dan French says that he has lived, slept, and dreamed of baseball for as long as he can remember. With Dan at the helm, The Strike Zone impacts a new generation of baseball players, helping kids achieve their goals, “no matter where they are, where they’re from, or their current skill level.” Dan’s idea for The Strike Zone started as a project when he was a senior at Southern Maine Community College. Tasked to write a business plan, Dan envisioned returning to Vermont to create a premier baseball and softball training facility that leverages technology to build and connect strong athletes to opportunities on a nationwide basis. Despite passion and planning, Dan learned that finding funding could be challenging. “We were shooting in the dark, shopping around for who would be willing to accept the business model I put together. There were a lot more “no’s” before I made my way to Community Capital.” Dan received a loan to build The Strike Zone from the ground up. “Community Capital saw what I was trying to do and understood. They are very involved in the businesses in which they invest. Once I made that connection, we hit the ground running. It was a very quick and easy process.” Dan notes that his experience with Community Capital departed from routine lending. The process was not transactional, consumed by collateral and credit. “I found confidence, knowing that I have the support of very highly skilled and knowledgeable individuals who care universally about me and my business. My courage translated directly to success with my business.” As a guiding principle, Dan cites the first lesson he learned as a coach: patience. He now instills patience in his athletes, helping them develop a sense of diligence, humility, and endurance, both on and off the field. “It’s going to be fun to see all our young guys grow up and see how they develop personally.” Now that he hit a home run with The Strike Zone, Dan is investigating next steps in franchise models. He credits the broad vision of success that Community Capital rooted within him with helping blaze a path to his future. “They want to see me continue to grow and evolve. I feel very humbled to have been able to come back home to Vermont and have such a high level of support for my business and my concepts. Without Community Capital this would not be possible. I promise to never let them down.”Investing in Entrepreneurs Statewide

Community Capital borrowers reflect the fabric of Vermont: authentic, innovative, service-oriented and invested in community.