We Are Community

Creating Resources for Resilience

Community Capital is a bridge to help individuals and their small businesses build the sales, experience and credit they need to become successful. Poor or limited credit history, high credit card balances, previous bankruptcies, and outstanding medical bills impede eligibility for traditional financing, and can hinder lower-income individuals across Vermont from creating economic opportunity for themselves, their families, and their communities. Through our statewide presence we maintain a broad range of investment in small businesses, helping people and communities flourish.

Community

Creating Businesses and Jobs

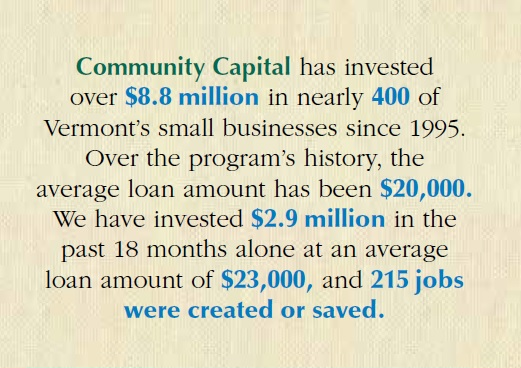

Community Capital has invested over $8.8 million in nearly 400 Vermont small businesses since 1995. Over the program’s history, the average loan amount per business has been $20,000.

Serving the Underserved

Picking up where commercial lenders leave off, 84% of Community Capital’s loans are to women, lower-income individuals, and start-ups.

Routinely Investing in Startups

Where others see risk, we see opportunity: Community Capital routinely invests in start-up businesses.

A comprehensive approach to creating jobs and sustainable communities

For every $6,000 of loan capital that Community Capital contributes, one job is created, and our average borrower provides two additional jobs to the Vermont economy.

Success is partnering for progress that impacts us all

- Supporting the growth of great businesses

- Empowering people who at some point lost their footing in life.

Success is providing counseling and training to increase the impact of achievement

- Business Advisory Services designs custom plans that define attainable goals to improve the viability of small businesses.

- Each partnership we foster champions the small businesses that fuel Vermont’s economy.